You created an accident and also were caught driving without automobile insurance policy. You were founded guilty of a DUI or DWI. You have a number of traffic offenses over a set time period such as six months. You lag on the youngster assistance bought by the courts. If any one of these statements put on your situation, you might need an SR-22.

If you don't have automobile insurance coverage, you'll need to purchase a vehicle insurance plan initially. It's most likely you'll be required to pay for a 6 month or annual plan in advance. If your permit was suspended for a DUI or various other serious violation, the cost of vehicle insurance will likely be high.

When you have a plan (or if you already have insurance policy), obtaining an SR-22 kind is simple. Call your car insurance coverage company to request an SR-22 as well as they'll manage the paperwork for you.

Just how a lot does SR-22 insurance coverage price? Individuals frequently ask just how much does SR-22 insurance policy cost a month. The quantity your automobile insurance coverage boosts depends on the insurance company.

The requirement to have one can last upwards of 3 years depending upon the offense intensity creating you to need one. Exactly how do I eliminate an SR-22? As soon as the DMV no longer needs you to have an SR-22, you'll need to ask your auto insurer to get rid of the SR-22.

The SR-22 requirement begins on the day of the conviction. The SR-22 requirement starts on the day of the accident.

The SR-22 requirement starts when you use for the license and also ends when the license expires. Out of State Declaring, Even if you live out of state, you must submit an SR 22 with Oregon (if needed) prior to one more state can issue you a motorist license.

The Greatest Guide To Sr-22 And Fr-44: Insurance Implications Of A Dui Conviction ...

You do not require to possess a car to acquire this sort of insurance coverage. If you do not own a cars and truck, ask your insurance provider concerning a non-owner SR-22 plan. For many offenses, you must bring this kind of insurance coverage plan for three years from the finishing day of any kind of abrogation.

An SR-22 is a type your insurer submits with the DMV to show you have the minimum obligation automobile insurance coverage your state requires. After being convicted of a major website traffic violation, such as DUI or driving without insurance policy, you are required to file an SR-22 to prevent your license from being withdrawed or put on hold.

You'll find solution to these concerns: Exactly how a lot does an SR-22 expense? The cheap car insurance majority of automobile insurer charge a cost to submit an SR-22 kind for you. This fee typically is in between $15 and $50, and also will reveal on your insurance coverage expense as an one-time charge. You will not pay this charge each year.

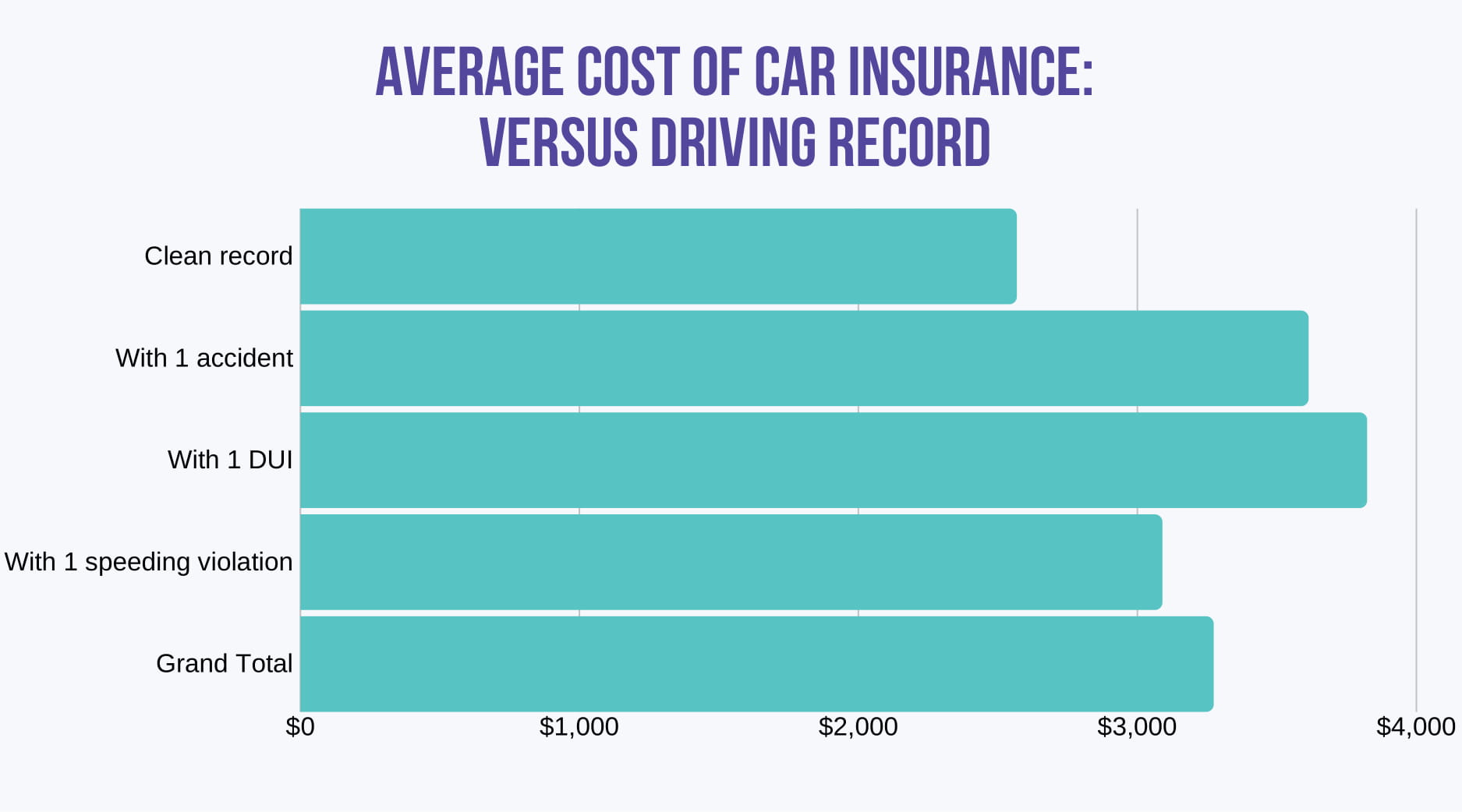

Severe criminal activities like Drunk drivings are much more likely to incur a significant hike in your premium than speeding. Insurance requirements are regulated on a state-by-state basis. States that have high population densities, varieties of without insurance motorists (such as Florida) or minimal insurance coverage needs, have some of the most expensive automobile insurance coverage prices in the country.

Our Dui And Insurance: Rates And Form Sr-22 - Findlaw Statements

If they can not or won't, look elsewhere. You'll be asked to pay a single charge for filing an SR-22, around $15 to $50. After you make your settlement, your insurance provider will submit the SR-22 in your place to your regional DMV. You should obtain a confirmation letter once the procedure is complete, so ensure you maintain it on document.

Contrast companies to obtain the most inexpensive SR-22 insurance coverage prices. See just how much you could conserve with a brand-new policy What is an SR-22? An SR-22 is a "certification of financial duty" your insurer will tack onto your plan to confirm that you satisfy the state minimal auto insurance requirements.